8 Easy Ways to Let Chase Know You’re Traveling – Don’t Risk Freezing Your Card!

Planning a trip is exciting, but there’s one thing you don’t want to forget—letting your bank know about your travel plans. If you don’t notify Chase about your upcoming adventure, they might freeze your card, thinking it’s being used fraudulently. Here are 8 easy ways to let Chase know you’re traveling so you can focus on enjoying your trip and avoid any hiccups.

1. Use the Chase Mobile App

The Chase mobile app is your best friend when it comes to managing your bank account, especially while traveling. You can easily notify Chase about your trip in just a few steps.

- How to do it:

- Log in to the app.

- Go to the “Profile & Settings” menu.

- Select “Travel Notifications.”

- Enter your travel dates and destinations.

- Hit submit, and you’re all set!

By using the app, you’ll have peace of mind knowing your travel plans are in the system.

2. Visit Chase Online

Don’t feel like using the app? No problem. You can notify Chase online through their website. It’s just as easy and straightforward.

- Steps:

- Sign in to your Chase account online.

- Navigate to “Secure Messages” or “Profile & Settings.”

- Select the “Travel Notification” option.

- Enter your trip details and submit.

This method is quick, and you can access it from any device with internet access.

3. Call Chase Customer Service

Prefer talking to a real person? You can always notify Chase of your travel plans by giving them a quick call.

- How to do it:

- Dial the number on the back of your Chase card.

- Speak to a customer service representative.

- Provide your travel dates and destinations.

This is an excellent option if you have other questions about your account or card while you’re traveling.

4. Send a Secure Message Online

If you’re already logged into your Chase account online, you can send them a secure message to notify them of your travel plans. This is a more personalized way of getting the message across.

- Steps:

- Log in to your Chase account.

- Go to “Secure Messages.”

- Type a message detailing your travel dates and locations.

- Hit send!

This method is especially useful if you have other questions or issues to discuss with Chase at the same time.

5. Use a Chase ATM

If you’re someone who frequents ATMs, you can notify Chase about your travel plans while withdrawing or depositing money.

- How to do it:

- Insert your card into a Chase ATM.

- Choose the “More Options” menu.

- Select “Travel Notification.”

- Enter your trip details.

Using an ATM is not only convenient, but it also allows you to handle multiple banking tasks in one go.

6. Chat With a Chase Representative

Chase also offers a chat feature on their website, which allows you to speak directly with a representative online.

- How to do it:

- Go to the Chase website.

- Log in to your account.

- Open the chat feature and let the representative know your travel details.

The chat option is convenient, especially if you’re multitasking and can’t hop on a phone call.

7. Visit a Chase Branch

If you prefer face-to-face interaction, you can always visit your local Chase branch and notify them of your travel plans in person.

- Steps:

- Bring your Chase card and ID.

- Speak to a banker.

- Provide your travel dates and destinations.

This method is ideal for anyone who has additional banking needs or questions to address before heading off on their trip.

8. Set Up Alerts on the App or Website

Although setting up travel notifications is essential, enabling account alerts is a good backup plan. Chase can send you alerts for any unusual activity, helping you manage your card more effectively while abroad.

- How to do it:

- Log in to the Chase app or website.

- Go to “Profile & Settings.”

- Choose “Alerts” and customize notifications for international or unusual charges.

With alerts, you’ll be able to stay on top of your account activity no matter where you are.

Why It’s Important to Notify Chase of Your Travel Plans

Letting Chase know you’re traveling is more than just a formality. Here’s why it’s crucial:

- Prevent Fraud Blocks: When Chase detects unusual activity—like a sudden charge in a foreign country—they may block your card for security reasons. This is great for protecting against fraud, but it’s a nightmare if you’re abroad and can’t access your money.

- Smooth Transactions: By notifying Chase in advance, you ensure that your card works seamlessly while you’re away, preventing any awkward moments at the cash register.

- Peace of Mind: Traveling comes with enough stress—don’t let a frozen credit card be one of them. Informing Chase gives you one less thing to worry about.

Additional Tips for Traveling with a Chase Card

Beyond notifying Chase, here are a few extra tips to ensure your trip goes off without a hitch:

- Carry Backup Payment Options: Always have more than one payment method available, such as a second credit card or some cash, in case your primary card doesn’t work.

- Monitor Your Transactions: Keep an eye on your account while you’re traveling. If you see any suspicious activity, report it to Chase immediately.

- Know Your Fees: Chase may charge foreign transaction fees, so it’s worth looking into your card’s terms before using it internationally. You might want to consider a card that offers no foreign transaction fees to save money.

What Happens if You Don’t Notify Chase of Your Travel Plans?

So, what’s the worst that could happen if you forget to notify Chase? Well, imagine this: you’re in a new country, ready to pay for a nice dinner, and—bam—your card gets declined. Panic sets in. You frantically check your balance, and everything looks fine, but your card is frozen. Why? Because Chase detected an unusual charge in a foreign country and flagged it as potential fraud. Not exactly the relaxing vacation you had in mind, right?

If Chase suspects that your card is being used fraudulently, they’ll freeze it as a protective measure. This is great when it’s actual fraud but a huge hassle when you’re just trying to pay for your hotel or souvenirs. That’s why setting up a travel notification is key—it prevents these unnecessary freezes and keeps your trip stress-free.

How Long Do Travel Notifications Last?

When you notify Chase of your travel plans, your notification will cover the duration of your trip, as specified when you set it up. But what if your trip gets extended, or you spontaneously decide to visit another country? In these cases, simply update your travel notification via the app, online, or by calling customer service. It’s quick, and updating ensures your card keeps working no matter where your adventures take you.

Pro tip: If you’re someone who frequently travels or makes international purchases, you might want to consider setting longer travel dates, or periodically checking and updating your notifications.

Can You Notify Chase Last-Minute?

Absolutely! Life is unpredictable, and sometimes you don’t have time to plan everything ahead. The good news is, notifying Chase about your travels can be done at the last minute. Even if you’re already on your way to the airport, it’s not too late. Whether you’re using the app, website, or making a quick phone call, you can notify Chase on the go, ensuring your card doesn’t freeze mid-trip.

Just make sure you do it before you start making purchases in your destination country. It’s best to notify Chase before you leave home to avoid any disruptions while you’re already in travel mode.

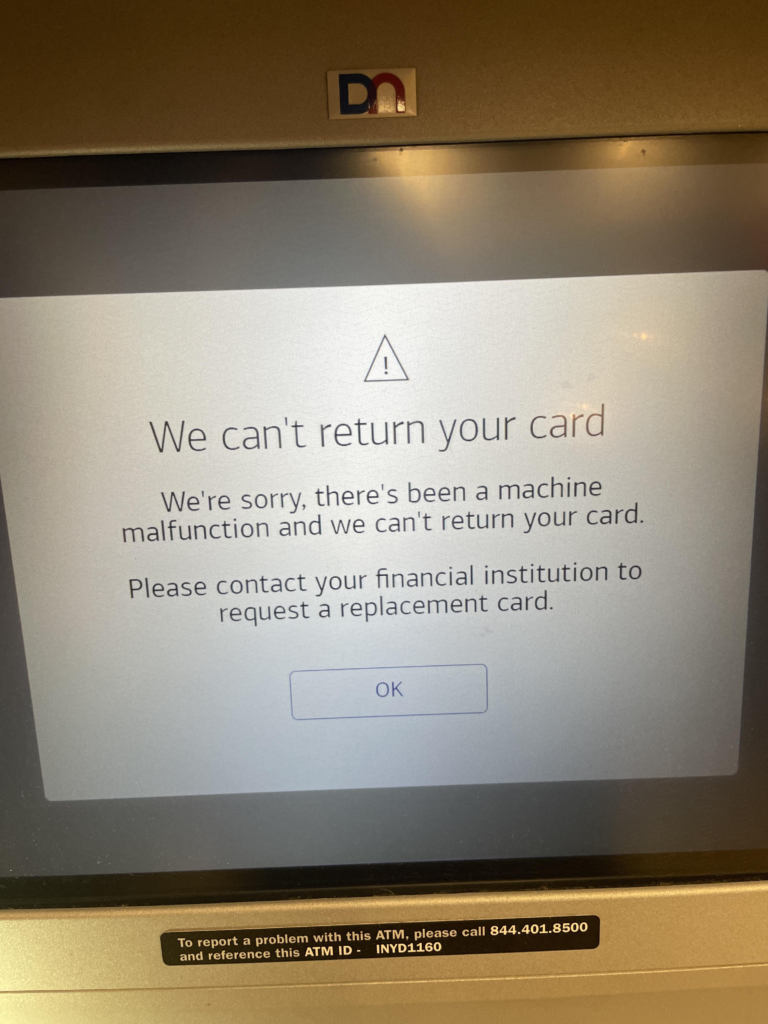

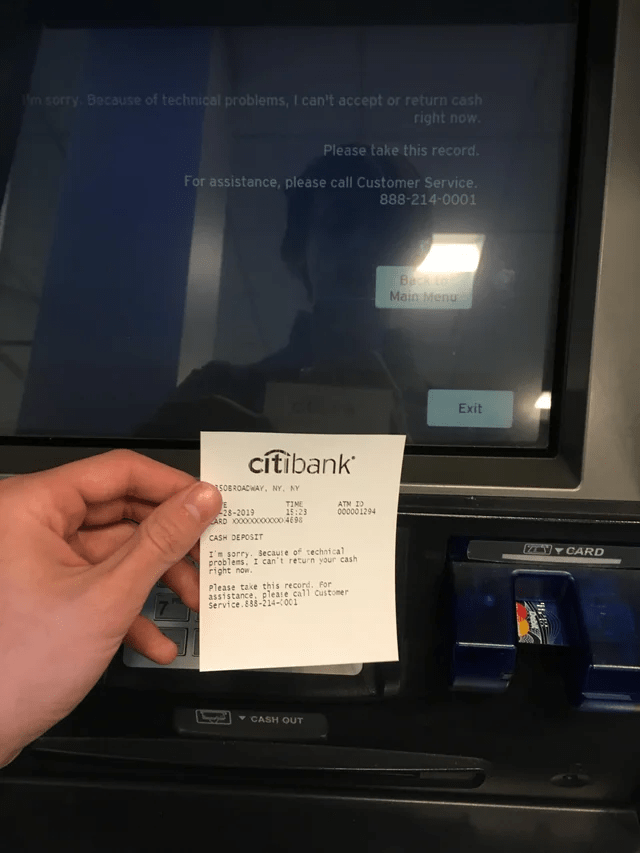

What If You Forget and Your Card Gets Frozen?

Oops! If you forgot to notify Chase and your card gets frozen while you’re abroad, don’t panic—it’s fixable! Here’s what to do if this happens:

- Call Chase Immediately – Dial the number on the back of your card, or use the app to contact customer support. Explain that you’re traveling, and they’ll unfreeze your card after verifying your identity.

- Use Secure Messaging – If you can’t call, log in to your account online and send a secure message detailing your situation. Chase usually responds quickly, and this can get your card reactivated without having to make an international call.

- Prepare Backup Payment Methods – While you’re waiting for your card to be unfrozen, use a backup credit card or cash. Having a second option handy can save you a lot of hassle during situations like this.

Once you’ve resolved the issue, make sure to set up a travel notification for the remainder of your trip so your card doesn’t freeze again!

Other Chase Travel Perks to Know About

Beyond travel notifications, Chase credit cards come with some pretty sweet travel perks that can enhance your experience. Here are a few perks you might want to take advantage of:

- No Foreign Transaction Fees: Some Chase cards, like the Chase Sapphire Preferred and Reserve, come with no foreign transaction fees. This is a huge bonus if you’re traveling internationally since you can save money on every purchase.

- Travel Insurance: Many Chase cards offer built-in travel insurance, covering everything from trip cancellations to lost luggage. Make sure to read your card’s benefits guide to know what’s covered and how to make a claim if needed.

- Purchase Protection: This perk comes in handy if something you buy while traveling gets stolen or damaged. Chase cards often provide purchase protection for eligible items, giving you added peace of mind.

- Fraud Protection: Even though travel notifications reduce the risk of a card freeze, Chase’s fraud protection still works around the clock to monitor your account for suspicious activity. If fraud is suspected, Chase will contact you immediately to verify any unusual charges.

Final Travel Prep Checklist

Before you jet off, make sure you’ve checked off the following travel prep tasks:

- Set a Travel Notification – Use the Chase app, website, or call customer service to notify Chase of your trip.

- Double-check Travel Dates – Make sure the travel notification covers your entire trip, and update it if plans change.

- Carry Backup Payment Methods – Pack a second credit card or some extra cash in case of emergencies.

- Review Chase Perks – Know the benefits of your specific Chase card, especially if you can save money with no foreign transaction fees or rely on built-in travel insurance.

- Keep the Chase Contact Info Handy – Jot down the number on the back of your card or have the app ready to go, just in case you need to reach customer service while you’re away.

Ready to Travel with Confidence?

Now that you know all the ways to notify Chase about your travel plans and how to take advantage of your card’s travel perks, you’re ready to explore the world without worrying about your card being frozen. By taking just a few minutes to set up a travel notification, you can travel confidently, knowing your card will work smoothly no matter where you go.

So, go ahead, pack your bags, and get ready to enjoy your trip without any financial worries. Safe travels!