7 Eye-Opening Facts About Lifetime Fitness Costs You Absolutely Need to Know!

Have you ever wondered how much your fitness journey truly costs? Maintaining a fit lifestyle isn’t just about gym memberships and personal trainers. From specialized classes to supplements, the hidden expenses can add up over a lifetime. Understanding these costs can help you make informed decisions about your fitness investments and maybe even save you some cash along the way!

Let’s dive into the real numbers and explore seven surprising facts about lifetime fitness expenses that might just change how you approach your fitness goals.

1. Gym Memberships Add Up Over the Years

Monthly gym fees might seem manageable, but when you add them up over decades, the costs can be staggering. A typical gym membership ranges from $30 to $100 a month, depending on the facility. Assuming you stay consistent with your membership, that could amount to $360 to $1,200 annually—and even more if you go for higher-end gyms or specialty studios.

The Real Cost

- Over 10 years, a basic gym membership could cost $3,600 to $12,000.

- For a lifetime commitment (let’s say 40 years), you might be looking at $14,400 to $48,000 in gym fees alone.

While gym memberships can provide access to valuable resources, considering how frequently you use them can help you decide if they’re worth the long-term expense.

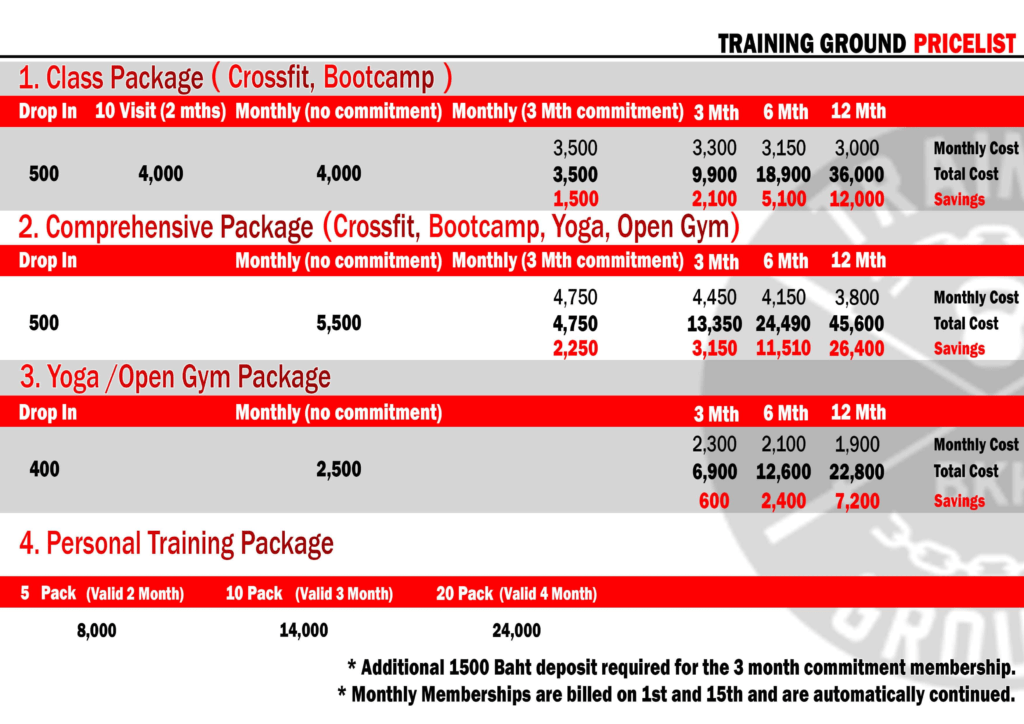

2. Personal Trainers and Specialty Classes Can Be Pricey

Hiring a personal trainer can make a big difference in reaching your fitness goals, but it comes with a price tag. On average, a personal training session can cost anywhere from $40 to $100, depending on the trainer’s experience and location. If you train with a personal trainer twice a week, that’s around $3,000 to $10,000 per year.

Specialized Classes

- Popular options like yoga, pilates, and HIIT classes range from $15 to $30 per session.

- Taking just two classes a week can add up to $1,500 to $3,000 per year.

If you prefer variety in your workouts, budgeting for these specialized classes can add up quickly. Consider balancing personal training with other, less costly options if your goal is to stay fit without breaking the bank.

3. At-Home Fitness Equipment is a Mixed Bag

Creating a home gym can save you from monthly membership fees, but there’s an upfront cost to consider. High-quality equipment like treadmills, weights, or stationary bikes can cost $1,000 to $3,000 each. Add in resistance bands, dumbbells, and yoga mats, and you’re looking at another $200 to $500.

Home Gym Costs Over Time

- Initial setup costs: $1,200 to $3,500.

- Long-term maintenance (replacement parts, upgrades): ~$200 annually.

With home gym equipment, the initial investment can pay off over time, but only if you’re committed to using it consistently. And remember, equipment does wear out, so factor in maintenance and potential replacements.

4. Fitness Apps and Online Subscriptions Are the New Norm

Fitness apps and online classes offer convenience and variety, but they often come with recurring fees. Many popular fitness apps range from $10 to $30 per month, translating to $120 to $360 per year. While this might seem inexpensive compared to in-person classes, it still adds up.

Lifetime Cost of Fitness Apps

- Over a decade, a $20 monthly subscription could cost you around $2,400.

- For a 40-year fitness journey, that’s approximately $9,600.

If you’re a fan of digital fitness, choose subscriptions that provide a variety of workouts to get the most value for your money.

5. Nutrition and Supplements: Hidden Costs You Don’t Notice

A balanced diet and the right supplements can enhance your performance, but they’re not cheap. Protein powders, pre-workouts, and vitamins can cost between $30 and $100 per month. Over a lifetime, this translates to thousands of dollars dedicated just to supplements.

Supplement Spending Breakdown

- Monthly supplements: $30 to $100.

- Annual cost: $360 to $1,200.

- Over 40 years: $14,400 to $48,000.

While supplements can be beneficial, they’re not always necessary. Try to get nutrients from whole foods first and only invest in supplements that truly support your goals.

6. Activewear and Gear Are Ongoing Expenses

We’ve all been there—investing in new workout gear feels great, and quality activewear can make a difference in comfort and performance. But constantly refreshing your fitness wardrobe can get expensive. A quality set of workout clothes (tops, bottoms, shoes) can easily cost $100 to $300 per outfit.

Annual Activewear Expenses

- Replacing workout gear twice a year: $200 to $600.

- Over 40 years, that’s around $8,000 to $24,000 on activewear alone.

To save, consider buying versatile, durable pieces that last longer and avoid buying gear impulsively.

7. The Cost of Recovery: Massages, Physio, and More

Recovery is an essential part of fitness, especially as you age. Massages, chiropractic care, and physical therapy sessions can cost $50 to $150 per session. If you go once a month, that’s an additional $600 to $1,800 per year. Not everyone includes recovery in their routine, but if you do, it’s worth factoring into your fitness budget.

Long-Term Recovery Costs

- Monthly sessions: $50 to $150.

- Annual cost: $600 to $1,800.

- Over 40 years: $24,000 to $72,000.

Investing in recovery helps prevent injuries and prolongs your fitness journey. Look for affordable options like foam rollers and online stretching guides to save on these costs.

Smart Tips for Managing Lifetime Fitness Costs

Now that you’re aware of the typical costs associated with fitness, here are some practical tips to help you make your fitness journey more affordable without sacrificing quality or results.

1. Take Advantage of Free or Low-Cost Workout Resources

You don’t always need a gym or a personal trainer to stay fit. Many online resources offer high-quality workout routines, often for free or at minimal costs. Platforms like YouTube, for example, have thousands of fitness channels covering everything from yoga to strength training.

- Try free apps and online workouts: Many fitness apps offer free trials, and some, like YouTube, are completely free for basic routines. Try a few out before committing to a paid subscription.

- Outdoor workouts: Consider jogging, cycling, or bodyweight exercises at a local park. Nature-based workouts can be refreshing, and they’re free!

2. Choose a Flexible Gym Membership

Some gyms now offer “pay-as-you-go” or “class pack” options, which let you pay for each visit rather than committing to a long-term contract. This is perfect if you know you won’t use the gym every day or prefer to mix up your routine with outdoor workouts or home exercises.

- Monthly vs. annual memberships: If you’re unsure about long-term commitment, a monthly membership may work better. Just remember, annual memberships are usually cheaper overall, so go for those if you’re dedicated.

- Family or student discounts: Many gyms offer discounts for students or family memberships, which can cut costs significantly if you’re working out with others.

3. Invest in Multi-Functional Home Equipment

If you’re interested in working out at home, start with versatile and compact equipment that covers a range of exercises. Resistance bands, adjustable dumbbells, and a yoga mat are excellent starter options, as they allow for various strength and flexibility exercises without taking up much space or costing a fortune.

- Avoid overly specialized equipment: Focus on versatile tools that allow for a wide range of workouts, instead of investing in expensive machines that might only be useful for one exercise.

- Look for second-hand equipment: Many people sell gently used fitness equipment online for a fraction of the original cost. Check local listings or community groups for deals.

4. Set a Budget for Supplements and Nutrition

While supplements can be beneficial, they’re not always necessary. Prioritize a balanced diet rich in whole foods before spending heavily on supplements. When you do choose supplements, focus on essentials and avoid unnecessary extras.

- Research before buying: Many supplements are marketed as essential, but not all of them are backed by science. Do your research and consult a healthcare professional to avoid wasting money on ineffective products.

- Bulk-buy for savings: If you find a product that works for you, consider buying in bulk to save on costs. Just make sure it’s something you’ll use consistently.

5. Shop Smart for Activewear and Gear

Activewear doesn’t have to break the bank, and you can often find quality workout clothes for less if you know where to look. Instead of going for trendy items that might not last, choose durable, high-quality basics.

- Shop sales and clearance sections: Many retailers offer sales throughout the year, and you can find quality items at a fraction of the price.

- Buy versatile, durable pieces: Look for activewear made from long-lasting materials that can withstand frequent use. You’ll spend less in the long run if you don’t need to replace your gear as often.

6. Embrace DIY Recovery Methods

While massages and therapy sessions can be beneficial, there are affordable ways to aid in muscle recovery. Foam rollers, massage balls, and stretching routines can help you reduce muscle soreness and prevent injuries without the high costs associated with professional recovery sessions.

- Invest in a foam roller: This one-time investment can go a long way in helping you with self-massage and stretching routines.

- Explore free resources: Many apps and online videos offer stretching and recovery techniques that you can do at home for free.

Why Managing Fitness Costs Matters for Your Long-Term Health

Fitness is an investment in your well-being, but that doesn’t mean it has to strain your wallet. By strategically planning and choosing budget-friendly options, you’re setting yourself up for a sustainable, long-term fitness journey that enhances both your physical and financial health.

The key is to understand where to spend, where to save, and how to create a balance. Remember, staying fit is not about having the flashiest gear or the most expensive memberships—it’s about consistency, dedication, and making informed choices that support your goals.

Take Control of Your Fitness Journey Today!

Ready to start saving without compromising on quality? Here’s a quick action plan to get started:

- Review your current fitness expenses and identify areas for adjustment.

- Research low-cost or free workout resources that fit your fitness style.

- Set a budget for fitness essentials like memberships, gear, and nutrition.

- Create a fitness schedule that includes a mix of gym, home, and outdoor workouts.

By following these steps, you’ll be on your way to achieving a healthy lifestyle that’s as good for your body as it is for your bank account.

Final Thoughts: Keep It Affordable, Keep It Consistent

Ultimately, fitness is a journey, not a destination. The costs associated with staying healthy should never be a deterrent. With the right approach, you can build an active lifestyle that aligns with your budget and helps you reach your goals.

As you continue on this path, remember that it’s okay to adjust your fitness expenses as your needs and goals evolve. The most important thing is to keep moving, stay motivated, and make choices that empower you to maintain your health for life.

Now it’s your turn: Have any tips for managing fitness expenses? Share them in the comments! And if you found this guide helpful, don’t forget to bookmark it for future reference or share it with a friend who’s on their own fitness journey.

Take the leap and make fitness a lasting, affordable part of your life!