When planning your dream vacation, you probably focus on flights, hotels, and sightseeing. But what about travel insurance? Many travelers overlook it, thinking it’s just another added expense. The truth? Travel insurance can be a lifesaver! But how much does it really cost, and is it worth the investment? Here are 7 shocking facts that will make you rethink your next trip!

1. Travel Insurance Costs Less Than You Think!

Most people assume travel insurance will blow their budget, but it’s surprisingly affordable! On average, travel insurance costs between 4% to 10% of your total trip cost. So, for a $2,000 trip, you’re looking at anywhere between $80 to $200—not bad for peace of mind, right?

What affects the cost? Well, factors like age, destination, and length of your trip come into play. Older travelers tend to pay more, while short domestic trips are usually on the cheaper side.

And here’s the kicker: many travelers spend more on a single night in a hotel than they would on a full policy to cover their entire trip!

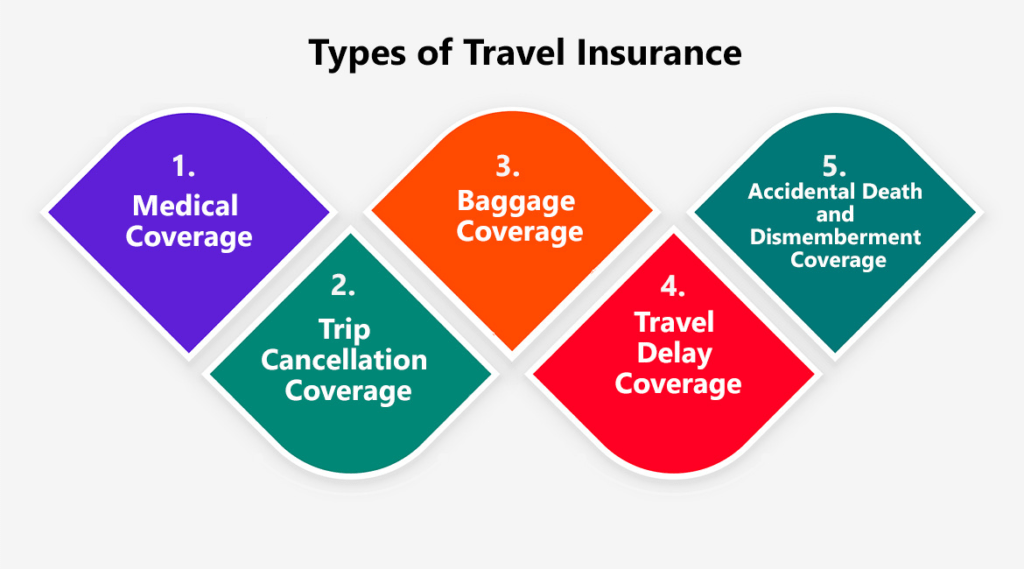

2. You Can Customize Your Coverage

Not all travel insurance policies are one-size-fits-all. The amount you pay can depend on the type of coverage you select. Want basic protection against flight cancellations? That’ll cost less. Prefer full coverage for medical emergencies, lost luggage, and trip interruptions? You’ll pay a little more.

You can also opt for add-ons, like adventure sports coverage or coverage for high-risk destinations. That flexibility lets you tailor your policy to fit your specific travel needs, so you’re not paying for something you don’t need!

3. Age Matters—A Lot

Here’s a surprising factor: your age can significantly impact your travel insurance cost. If you’re under 40, you’re likely to score a lower premium. But travelers over 60 or 70 may see their rates increase by as much as 50%!

Why the jump? Insurance companies see older travelers as a higher risk due to potential health issues. Even if you’re in great shape, expect to pay more the older you get. So, if you’ve got a birthday coming up, you might want to book that trip sooner rather than later to lock in a lower rate!

4. Pre-Existing Conditions Might Not Be Covered

Got a pre-existing medical condition? You’ll need to read the fine print. Most travel insurance policies don’t cover pre-existing conditions unless you opt for a specialized plan or purchase your policy within a specific timeframe (usually 14-21 days after booking your trip).

Don’t assume you’re automatically covered. If you’re on medication or have a chronic condition, make sure you get a pre-existing conditions waiver to avoid nasty surprises. Otherwise, that insurance might not help when you need it most!

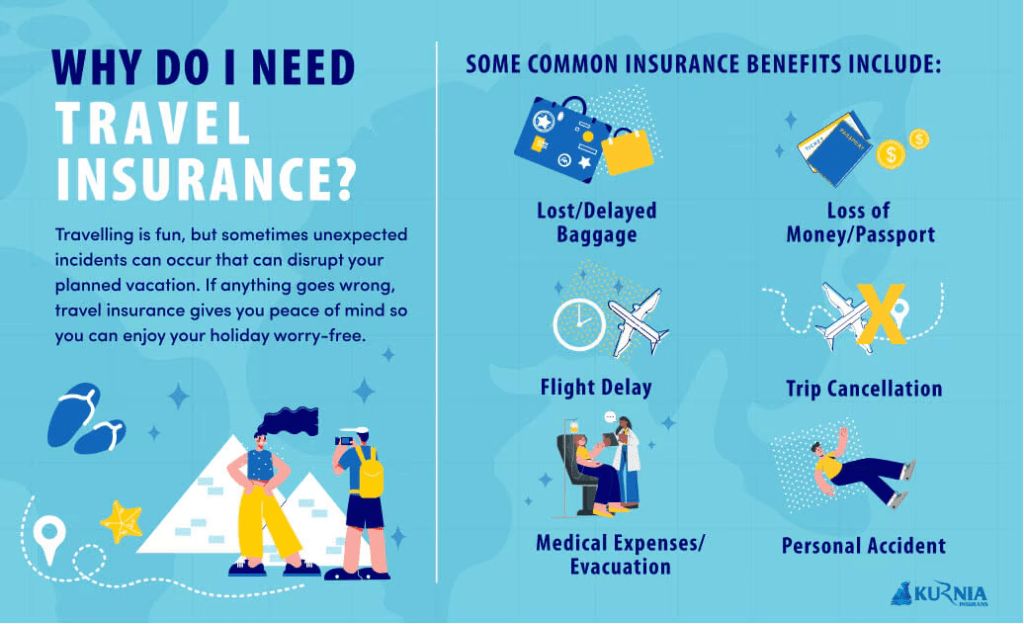

5. Travel Insurance Covers More Than You Think

Did you know travel insurance covers more than just trip cancellations? It can protect you from a host of unexpected situations, including:

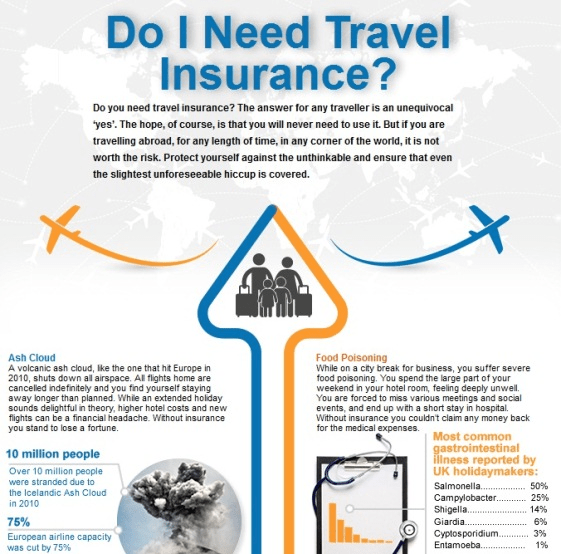

- Medical Emergencies: If you get sick or injured while abroad, travel insurance can cover your hospital bills, medication, and even medical evacuation (which can cost up to $100,000!).

- Lost Luggage: Ever had your luggage vanish into thin air? Travel insurance can reimburse you for lost, stolen, or delayed bags.

- Trip Interruptions: If you need to cut your trip short due to an emergency back home, your insurance can cover the cost of your unused bookings.

Plus, some policies even offer perks like trip delay compensation or 24/7 travel assistance. Talk about a safety net!

6. It Might Be Required for Your Destination

Here’s one fact that often shocks travelers: some countries require proof of travel insurance for entry! Popular spots like Cuba, Thailand, and the Schengen Area (Europe) demand that you show proof of medical coverage before you can set foot on their soil.

Don’t get caught off guard at immigration! Always check if your destination has specific travel insurance requirements before you board your flight.

7. You Might Already Have Travel Insurance and Not Even Know It!

Ready for a shocker? You might already have travel insurance without realizing it. Many premium credit cards offer built-in travel insurance if you book your trip using their card. These policies typically cover trip cancellations, lost luggage, and even some medical emergencies.

But before you rely on your card, make sure you check the limits. Often, these policies don’t offer the same level of coverage as standalone plans, and you might need to purchase additional insurance for high-risk activities or long trips.

So, Is Travel Insurance Worth the Cost?

Absolutely! Considering the potential financial disaster of an unexpected event while traveling, travel insurance is a small price to pay for peace of mind. For just a fraction of your trip cost, you can ensure that medical emergencies, cancellations, or lost luggage don’t derail your vacation—or your bank account.

Next time you plan a trip, don’t skip this crucial step! Do a little research, shop around for a policy that fits your needs, and enjoy your vacation worry-free.

Bonus: How to Choose the Right Travel Insurance for Your Trip

Now that you know how much travel insurance costs and what it covers, the next step is figuring out which policy is best for you. Not all insurance plans are created equal, and picking the right one can save you headaches later. Here are a few tips to help you make the best choice:

1. Assess Your Trip’s Risk Level

Are you heading to a tropical beach for some R&R, or embarking on an adventure-filled trip with hiking, scuba diving, or skiing? The risk level of your activities will impact the type of coverage you need. For instance, standard travel insurance may not cover extreme sports, so make sure you get a plan that includes adventure sports coverage if you’re planning anything risky.

Also, consider the health risks of your destination. If you’re traveling to a country where healthcare isn’t easily accessible, having emergency medical evacuation coverage could be a lifesaver.

2. Compare Different Insurance Providers

Just like you shop around for flights and hotels, you should also compare different travel insurance providers. Each insurer has its own set of benefits, exclusions, and pricing. Don’t just settle for the first plan you find—take the time to compare policies based on what’s most important to you, whether it’s medical coverage, trip cancellation protection, or lost baggage reimbursement.

You can use travel insurance comparison websites like InsureMyTrip or Squaremouth to see side-by-side options and find the best deal for your needs.

3. Don’t Forget About the Fine Print

You know those boring terms and conditions? Read them! Policies can have hidden clauses that might leave you without coverage when you need it most. Here are some key questions to ask:

- Does it cover pre-existing conditions?

- What are the coverage limits for medical expenses and trip cancellations?

- Does it include adventure or high-risk activities?

- Are there any exclusions (e.g., certain countries or activities)?

Understanding the fine print will help you avoid unpleasant surprises and ensure you’re covered when it matters most.

4. Purchase Your Insurance Early

The earlier you buy travel insurance, the better. Why? Because if something unexpected happens before your trip—like an illness, injury, or family emergency—you’ll be covered for trip cancellations or delays. If you wait until just before you depart, you might miss the window for coverage on certain elements like pre-existing conditions or cancel for any reason (CFAR) coverage.

Ideally, purchase your insurance within 14-21 days of booking your trip for the best coverage options.

Frequently Asked Questions About Travel Insurance

You might still have some questions about travel insurance, and that’s totally normal. Let’s dive into a few common FAQs to clear things up:

Q1: Can I Get Travel Insurance If I’m Already Abroad?

Yes, but it’s trickier. Some providers allow you to purchase coverage even after you’ve started your trip, but this type of insurance often has limited options and can be more expensive. It’s always best to buy before you leave to ensure full protection.

Q2: Is Travel Insurance Refundable?

Typically, travel insurance policies offer a “free look period” (usually around 10-14 days), during which you can cancel the policy for a full refund—provided you haven’t started your trip or filed a claim. Once this period passes, most policies become non-refundable.

Q3: Will My Health Insurance Cover Me Overseas?

In most cases, your domestic health insurance won’t cover you abroad. This is especially true for countries that don’t have reciprocal healthcare agreements with your home country. Always check with your health insurance provider before you travel, but don’t rely on it as your sole source of protection. Travel insurance offers the kind of comprehensive medical coverage you’ll need when abroad.

Q4: Can I Get a Policy That Covers COVID-19?

Yes, many travel insurance providers now offer policies that cover COVID-19-related expenses, including medical treatment, trip cancellations, or interruptions due to contracting the virus. Make sure you select a plan that clearly states it includes pandemic coverage if you’re concerned about this risk.

The Bottom Line: Don’t Leave Home Without Travel Insurance

Travel insurance is one of those things you hope you never have to use, but when things go wrong, you’ll be glad you have it. From covering expensive medical bills in foreign countries to reimbursing you for unexpected trip cancellations, the protection it offers far outweighs the cost. It’s a small price to pay for peace of mind and the security of knowing you’re covered no matter what happens.

Whether you’re traveling for leisure or business, to a tropical beach or a bustling city, make sure you’re prepared. After all, it’s better to be safe than sorry. As you’ve seen from the 7 shocking facts, travel insurance doesn’t have to break the bank, but it can definitely save you a fortune in the long run.

Share Your Experience

Have you ever had to use travel insurance during a trip? Was it worth it? Share your story in the comments below—we’d love to hear from you! If you’ve found this guide helpful, don’t forget to pass it along to other travelers who may be planning their next adventure.

And remember, travel smart, stay safe, and happy exploring!

Need more travel tips and advice? Make sure to check out our other guides on how to stay safe, save money, and get the most out of your trips. Whether you’re a first-time traveler or a seasoned globetrotter, there’s always something new to learn.

Safe travels, and see you out there! 🌍✈️