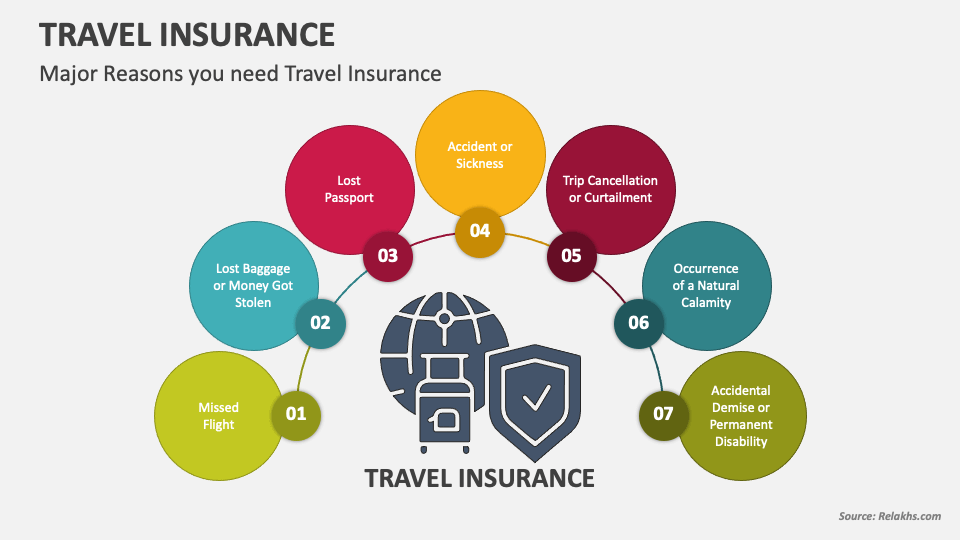

7 Powerful Reasons You Absolutely Shouldn’t Skip Travel Insurance!

Wondering if travel insurance is worth it? Spoiler alert: it totally is! Whether you’re jetting off on a dream vacation or heading out for a quick weekend getaway, travel insurance can be a real lifesaver (literally and figuratively). But if you’re still on the fence, here are 7 powerful reasons why you absolutely shouldn’t skip travel insurance on your next trip.

1. Medical Emergencies Can Get Expensive—Fast

Imagine this: you’re hiking in the mountains, soaking in breathtaking views, and suddenly you twist your ankle or worse, need emergency medical care. Depending on where you are, medical costs can skyrocket, especially if you’re in a foreign country.

Travel insurance can cover medical emergencies abroad, including hospital visits, surgeries, or even medical evacuations. Trust me, you don’t want to end up paying thousands out of pocket for an unexpected medical issue while trying to enjoy your vacation.

2. Trip Cancellations Are More Common Than You Think

Life happens. You might fall sick, a family emergency could pop up, or bad weather might disrupt your plans. If you’ve prepaid for flights, hotels, and tours, canceling last minute can mean losing a big chunk of money.

With travel insurance, you can get reimbursed for these non-refundable expenses if you cancel for a covered reason. This way, you won’t have to worry about your hard-earned money going down the drain.

3. Lost or Delayed Luggage Is a Nightmare

One of the worst feelings is arriving at your destination, ready to explore, only to find out that your luggage is lost, delayed, or worse—stolen. You’ll be left scrambling to buy clothes, toiletries, and other essentials.

Travel insurance can provide coverage for lost, stolen, or delayed luggage. So, while it won’t bring your luggage back instantly, it’ll at least cover the cost of buying what you need until your bags turn up (if they ever do).

4. Travel Delays Happen More Than You Expect

Travel delays aren’t just annoying—they can be costly, too. A missed flight connection might mean extra hotel stays, meals, and transportation costs.

The right travel insurance will reimburse you for these unexpected costs caused by flight delays or cancellations, making the whole situation a little less painful.

5. Natural Disasters Can Ruin Your Trip

Imagine booking your tropical getaway, only to have a hurricane or earthquake hit your destination just before or during your trip. Natural disasters are unpredictable and can not only ruin your vacation but also leave you stuck, needing to evacuate or extend your stay.

With travel insurance, you can get coverage for trip cancellations or interruptions due to natural disasters. It also covers the costs if you need to be evacuated from an area affected by one.

6. You Can Get Help 24/7, Anywhere in the World

One of the lesser-known perks of travel insurance is access to 24/7 emergency assistance. Lost your passport? Your insurance provider can help you figure out what to do. Need to find a local hospital while you’re in a country where you don’t speak the language? They’ve got your back.

This round-the-clock assistance can be a lifesaver when you’re far from home and don’t know where to turn for help.

7. It’s Affordable Peace of Mind

Most people think travel insurance is expensive, but it’s often a small fraction of the total trip cost. For the peace of mind it offers, the price is worth it.

Whether you’re protecting yourself from medical emergencies, lost luggage, or trip cancellations, travel insurance ensures you can enjoy your trip without constantly worrying about the “what ifs.”

How to Choose the Right Travel Insurance Plan

Now that you know why travel insurance is a must-have, let’s talk about how to pick the right plan. Not all travel insurance is created equal, so you want to make sure you’re getting coverage that actually meets your needs.

Here’s a quick checklist to help you choose the perfect travel insurance:

1. Assess Your Needs

Start by considering your trip. Are you traveling internationally or domestically? Are you going on a cruise or an adventurous trek? These factors matter because different plans cater to different types of trips.

For example, if you’re going on a safari, you’ll need a plan that covers emergency evacuations. But if you’re just flying to another city for a conference, basic coverage for delays and cancellations might be enough.

2. Look for Medical Coverage

Medical coverage is one of the most important features of travel insurance. Make sure the plan includes emergency medical treatment and covers accidents or illnesses. Check the maximum coverage limit—some plans cap this amount, so make sure it’s high enough to cover potential hospital bills.

Also, don’t forget to check whether pre-existing conditions are covered. If you have any ongoing medical issues, you’ll need a plan that offers coverage for those as well.

3. Check for Trip Cancellation and Interruption Coverage

Trip cancellation or interruption coverage can save you from financial loss if you need to cancel your trip for a covered reason (like illness or family emergencies). Always review the fine print to know what counts as a “covered reason.”

Some plans even offer “Cancel for Any Reason” (CFAR) coverage. This allows you to cancel for, well, any reason—whether you suddenly don’t feel like going or if you have concerns about COVID-19.

4. Don’t Forget About Lost or Delayed Luggage

Lost or delayed luggage is a common travel nightmare. Some insurance plans offer reimbursement for personal items if your luggage is delayed, lost, or stolen. This coverage can be a real lifesaver when you’re stuck in a new city without your essentials.

5. Check for Adventure or Extreme Sports Coverage

Planning on skiing, scuba diving, or some other extreme adventure? Not all travel insurance covers these activities, so if you’re the adventurous type, look for a plan that includes coverage for high-risk sports.

6. Emergency Evacuation Coverage

If you’re traveling to remote areas or destinations prone to natural disasters, emergency evacuation coverage is a must. This ensures that if you need to be airlifted out due to a medical emergency or natural disaster, you won’t be stuck paying the hefty bill.

Common Misconceptions About Travel Insurance

There are some myths and misconceptions about travel insurance that can make people hesitant to purchase it. Let’s clear up a few of the most common ones:

“My credit card already provides travel insurance.”

While it’s true that some credit cards offer travel insurance as a perk, this coverage is often limited. It may not include crucial things like medical emergencies or comprehensive trip cancellation coverage. Always read the fine print and consider if you need extra coverage to fill any gaps.

“I’m healthy, I don’t need medical coverage.”

Even if you’re in great health, accidents happen. You could slip on a wet floor, get food poisoning, or have an allergic reaction. The point of travel insurance is to cover the unexpected, so don’t assume your good health will protect you from a surprise hospital bill.

“It’s too expensive.”

This is a common misconception. Travel insurance is actually pretty affordable, especially compared to the potential costs of an emergency. You can often find plans that fit within your budget, and even basic coverage can make a huge difference when things go wrong.

How to File a Travel Insurance Claim

Once you’ve purchased your travel insurance, the last thing you want is to have to use it. But if something does go wrong, it’s important to know how to file a claim properly to ensure a smooth process and quick reimbursement.

1. Contact Your Insurance Provider Immediately

If something happens during your trip—whether it’s a medical emergency, lost luggage, or a cancellation—get in touch with your travel insurance provider as soon as possible. Most companies have 24/7 hotlines to assist you.

By contacting them right away, you can get advice on what steps to take and ensure you follow the proper procedures. They might require you to visit a specific hospital or file a police report in the case of theft, for instance.

2. Gather the Necessary Documentation

Insurance claims require documentation, so be prepared to collect and submit proof of your situation. This could include:

- Receipts: For any medical bills, hotel stays, or replacement items for lost luggage.

- Police reports: If you were the victim of theft or an accident.

- Flight details: Proof of delays or cancellations from your airline.

- Photos: For any damaged or lost items.

The more documentation you have, the smoother the claims process will go.

3. Submit Your Claim Promptly

Don’t wait too long to file your claim. Many travel insurance policies have deadlines for submitting claims, typically within a few days to a few weeks after the incident occurs. Delaying your claim submission could result in a denial.

4. Follow Up on Your Claim

After you’ve submitted your claim, don’t be afraid to follow up with your insurance company. They’ll likely give you a timeframe for when you can expect a decision, but checking in on the status of your claim can help avoid delays or miscommunications.

How Much Does Travel Insurance Cost?

The cost of travel insurance depends on several factors, including the length of your trip, destination, age, and the level of coverage you choose. On average, a comprehensive travel insurance policy typically costs between 4% to 10% of the total trip cost.

For example:

- For a $2,500 trip, expect to pay around $100 to $250 for travel insurance.

- For a $5,000 trip, it might cost between $200 and $500.

While this may seem like an added expense, it’s a small price to pay for peace of mind and protection against potentially huge costs if something goes wrong.

If you’re traveling on a budget, you can also opt for more basic coverage that focuses on essential benefits like medical emergencies and trip cancellations, keeping the cost even lower.

Final Thoughts: Don’t Risk Traveling Without Insurance

Travel is full of surprises—some amazing, others not so much. And while we all hope for the best when embarking on our adventures, it’s smart to be prepared for the unexpected. From delayed flights to medical emergencies, travel insurance offers a financial safety net that can help you handle those surprises with ease.

By investing in travel insurance, you’re not just protecting your trip—you’re safeguarding your well-being and your peace of mind. So, before you pack your bags for that next adventure, take a moment to secure the right travel insurance plan. Trust me, it’s a decision you won’t regret.

Safe travels!

FAQ: Travel Insurance Basics

Q: Does travel insurance cover pre-existing conditions?

A: Some travel insurance policies do cover pre-existing conditions, but you’ll need to look for plans that specifically mention it. Often, you’ll need to purchase the policy within a specific timeframe after booking your trip, typically 14 to 21 days, for pre-existing conditions to be covered.

Q: Can I cancel my travel insurance policy if my trip is canceled?

A: Yes, many travel insurance policies offer a free-look period, usually around 10 to 15 days, during which you can cancel for a full refund if you haven’t left on your trip or made a claim.

Q: Is travel insurance mandatory?

A: No, travel insurance is not typically required for most destinations, though some countries—like Cuba, Turkey, and some European Union nations—do require visitors to have medical insurance. Even if it’s not mandatory, it’s highly recommended for the reasons we’ve discussed.

Q: Can I buy travel insurance after my trip has started?

A: Most insurers require you to buy your policy before your trip starts, but some companies offer limited coverage even after you’ve departed. However, your options may be restricted, and coverage may be more expensive.

Q: Does travel insurance cover rental car accidents?

A: Some travel insurance policies include coverage for rental car accidents or offer it as an add-on. Be sure to check your policy details or consider purchasing insurance directly through your car rental company for additional peace of mind.